TAX - VAT Merging: 1st SDDP

|

The TAX - VAT Merging: 1st SDDP Structured Democratic Dialogue Process has been conducted in the context of the ad hoc Merging of TAX - VAT Services in Cyprus project.

Executive Summary

During the period 7-19 November, the project team , in collaboration with the Cyprus Academy of Public Administration ( CAPA ), conducted three consultation meetings - workshops with all interested stakeholders in-order to analyze the smooth transition of merging the Services provided by the Department of Inland Revenue (i.e., TAX) and the Value Added Tax Services (VAT). The aim of the first SDDP workshop was to identify the Challenges that people and organizational structured would face during this transition.

The Triggering Question (TQ) of the first workshop was:

"What are the challenges that should be addressed for the successful merging of TAX and VAT deparments?"

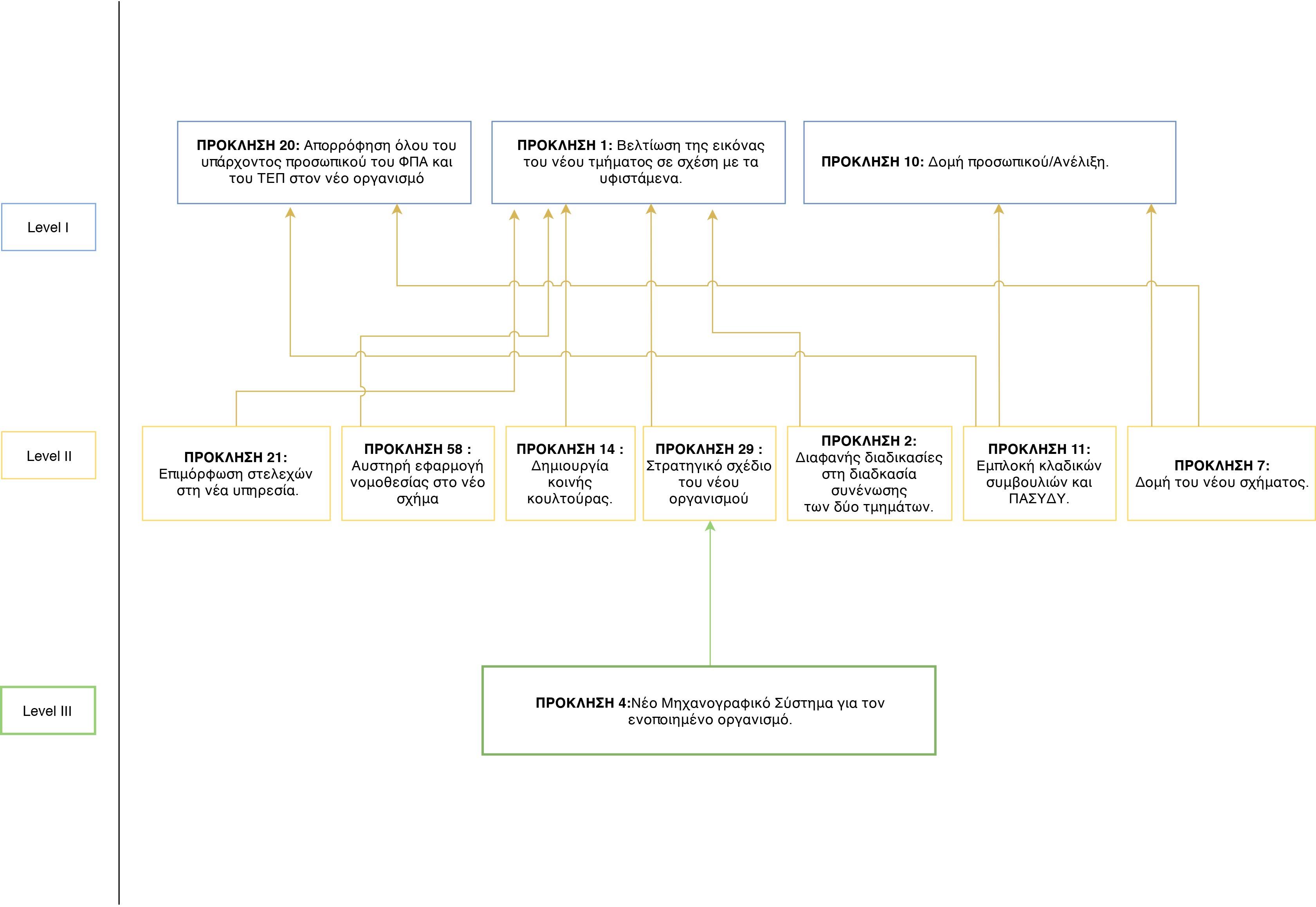

In response to the TQ, the 24 participants came up with 75 challenges, which were categorized in 12 clusters. Following the voting process, 49 ideas received one or more votes and were structured to create the influence MAP shown below.

File:TAX - VAT Merging 1st SDDP.pdf

File:TAX - VAT Merging 1st SDDP.pdf

According to the participants of this workshop, the challenges that appear to be the most influential were:

- Challenge #4: Νέο Μηχανογραφικό Σύστημα για τον ενοποιημένο οργανισμό

- Challenge #21: Επιμόρφωση στελεχών στη νέα υπηρεσία.

- Challenge #5: Κοινή πλατφόρμα πληροφοριών.

- Challenge #8: Εξασφάλιση και στελέχωση προσωπικού.

- Challenge #14:Δημιουργία κοινής κουλτούρας.

- Challenge #29: Στρατηγικό σχέδιο του νέου οργανισμού.

- Challenge #2: Διαφανής διαδικασίες στη διαδκασία συνένωσης των δύο τμημάτων.

- Challenge #11: Εμπλοκή κλαδικών συμβουλιών και ΠΑΣΥΔΥ.

- Challenge #7: Δομή του νέου σχήματος.

The workshop was mainly facilitated by Marios Michaelides and Yiannis Laouris.

In sum, the participants of the dialogue reported their satisfaction that they had the opportunity to exchange ideas regarding the challenges and got engaged for the follow-up workshop to define the expectations.